graph LR

I[Investment] --> V[Visits]

V --> S[Sales]

Se[Seasonality] --> I

Se --> S

Mediator variables, sales funnel and frontdoor adjustment

In Marketing Mix Modeling (MMM), we often encounter variables that sit between the marketing investment and the final conversion (sales). These are called mediators. Common examples include website visits, app installs, lead generation, or footfall in a store.

A common dilemma is whether to include these mediators in the MMM:

- If we exclude them: We lose valuable information. Mediators are often measured more accurately or with higher frequency than sales, and they can help explain variance.

- If we include them naively: We risk “blocking” the effect of the media. If the causal path is

Media -> Visits -> Sales, and we control forVisitsin a regression, the coefficient forMediawill reflect only the direct effect of Media on Sales (which might be zero), not the total effect. This leads to underestimating the ROI of the media channel.

This tutorial demonstrates how to use Prophetverse to model this causal chain explicitly. We will build a model that respects the funnel structure: Investment drives Visits, and Visits drive Sales. This allows us to use the data from visits to improve our estimates without breaking the causal inference for investment ROI.

Data Generation

First, let’s generate some synthetic data where the ground truth is known. We assume a simple funnel:

- Investment drives Visits (with adstock and saturation).

- Visits drive Sales (with a conversion rate).

- There is no direct path from Investment to Sales (Direct Effect = 0).

- There is also some seasonality affecting both.

Code

from prophetverse import (

Prophetverse,

Constant,

LinearFourierSeasonality,

GeometricAdstockEffect,

MultiplyEffects,

Forward,

IgnoreInput,

MichaelisMentenEffect,

PriorPredictiveInferenceEngine,

ChainedEffects,

)

from prophetverse.utils.regex import exact

import numpyro.distributions as dist

import numpy as np

import pandas as pd

# Synthetic data

rng = np.random.default_rng(42)

n = 356

idx = pd.period_range(start="2020-01-01", periods=n, freq="D")

X = pd.DataFrame(index=idx)

X["investment"] = rng.normal(loc=500, scale=100, size=n).clip(min=0)

X["investment"] += 100 * np.sin(np.linspace(0, n, n) * 2 * np.pi / 30.25) # seasonality

# Smooth a little

X["investment"] = X["investment"].rolling(window=7, min_periods=1).mean()

true_model = Prophetverse(

trend=Constant(prior=dist.Delta(1000.0)),

inference_engine=PriorPredictiveInferenceEngine(),

exogenous_effects=[

(

"latent/seasonality",

LinearFourierSeasonality(

sp_list=[30.25], fourier_terms_list=[1], freq="D", prior_scale=0.5

),

None,

),

(

"seasonality",

MultiplyEffects(

effects=[

("trend", Forward("trend")),

("seasonality", Forward("latent/seasonality")),

]

),

None,

),

(

"latent/visits",

MultiplyEffects(

effects=[

("trend", Forward("trend")),

(

"investment",

ChainedEffects(

steps=[

(

"adstock",

GeometricAdstockEffect(

decay_prior=dist.Delta(0.5),

normalize=True,

),

),

(

"saturation",

MichaelisMentenEffect(

"additive",

max_effect_prior=dist.Delta(2.1),

half_saturation_prior=dist.Delta(400.0),

),

),

]

),

),

],

),

exact("investment"),

),

(

"visit_sales",

MultiplyEffects(

effects=[

("awareness", Forward("latent/visits")),

(

"conversion",

Constant(prior=dist.Delta(0.5)),

),

]

),

None,

),

],

)

# The y will be ignored - we just want to sample from the prior predictive

true_model.fit(y=pd.Series(index=idx, data=0), X=X)

components = true_model.predict_components(X=X, fh=X.index)

y = components["obs"].to_frame("sales") * rng.normal(

loc=1.0, scale=0.01, size=n

).reshape((-1, 1))

X["visits"] = components["latent/visits"]/opt/hostedtoolcache/Python/3.11.14/x64/lib/python3.11/site-packages/tqdm/auto.py:21: TqdmWarning: IProgress not found. Please update jupyter and ipywidgets. See https://ipywidgets.readthedocs.io/en/stable/user_install.html

from .autonotebook import tqdm as notebook_tqdmimport matplotlib.pyplot as plt

fig, axs = plt.subplots(figsize=(6, 6), nrows=3, sharex=True)

y.plot(ax=axs[0], title="Sales", color="C0")

axs[0].set_ylabel("Sales")

X["visits"].plot(ax=axs[1], title="Visits", color="C1")

axs[1].set_ylabel("Visits")

X["investment"].plot(ax=axs[2], title="Ad Investment", color="C2")

axs[2].set_ylabel("Investment")

plt.tight_layout()

plt.show()

from prophetverse import (

Prophetverse,

Constant,

LinearFourierSeasonality,

GeometricAdstockEffect,

MultiplyEffects,

Forward,

IgnoreInput,

MichaelisMentenEffect,

MAPInferenceEngine,

ChainedEffects,

FlatTrend,

CoupledExactLikelihood,

Identity,

)

from prophetverse.utils.regex import exact

import numpyro.distributions as dist

import numpy as np

import pandas as pd

import numpyro

numpyro.enable_x64()To evaluate our models, we define a helper function to calculate the Total Treatment Effect of the investment. This is done by comparing the predicted sales with the actual investment versus a counterfactual scenario where investment is zero.

def get_treatment_effect(model, X):

# True model (unobserved)

y_true_cf_0 = model.predict(X=X.assign(investment=0.0), fh=X.index)

y_true_cf_1 = model.predict(X=X, fh=X.index)

return y_true_cf_1 - y_true_cf_0

delta_true = get_treatment_effect(true_model, X)Naive model - using mediator as input

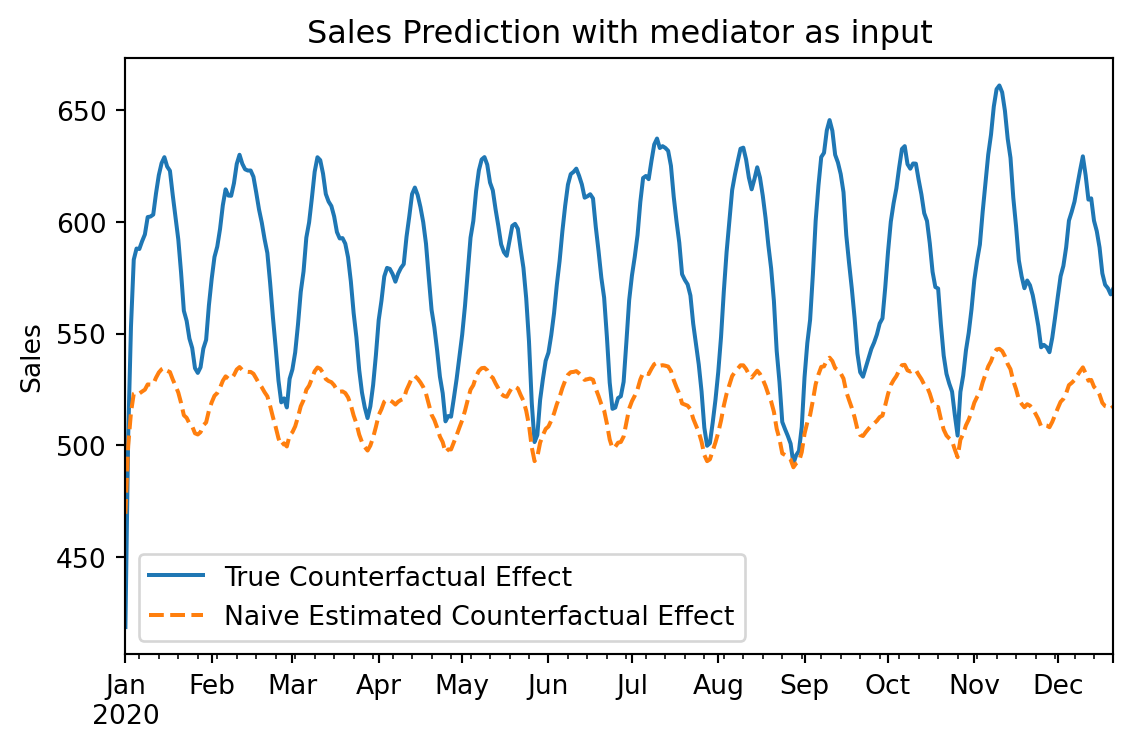

In the naive approach, we simply include both investment and visits as features in the model. We might think that “more data is better”, but in causal inference, this is a classic mistake known as adjusting for a mediator.

Since visits is a direct consequence of investment and a direct cause of sales, including it in the regression “blocks” the path from investment to sales. The model will attribute the sales lift to visits (which is closer to the outcome) and find little to no effect for investment.

Let’s see what happens when we fit this model.

from prophetverse import (

Prophetverse,

Constant,

LinearFourierSeasonality,

GeometricAdstockEffect,

MultiplyEffects,

Forward,

IgnoreInput,

MichaelisMentenEffect,

MAPInferenceEngine,

ChainedEffects,

FlatTrend,

CoupledExactLikelihood,

Identity,

LinearEffect,

)

from prophetverse.utils.regex import exact

import numpyro.distributions as dist

import numpy as np

import pandas as pd

import numpyro

numpyro.enable_x64()seasonality = (

"seasonality",

MultiplyEffects(

effects=[

("trend", Forward("trend")),

(

"seasonality",

LinearFourierSeasonality(

sp_list=[30.25],

fourier_terms_list=[1],

freq="D",

prior_scale=0.1,

),

),

]

),

None,

)

investment_saturation_adstock = MultiplyEffects(

effects=[

("trend", Forward("trend")),

(

"investment",

ChainedEffects(

steps=[

(

"adstock",

GeometricAdstockEffect(

decay_prior=dist.InverseGamma(4, 2),

normalize=True,

),

),

(

"saturation",

MichaelisMentenEffect(

"additive",

max_effect_prior=dist.HalfNormal(1),

half_saturation_prior=dist.HalfNormal(400),

),

),

]

),

),

],

)naive_model = Prophetverse(

trend=FlatTrend(changepoint_prior_scale=1000),

inference_engine=MAPInferenceEngine(progress_bar=True),

exogenous_effects=[

# Multiplicative seasonality

seasonality,

# Investment

(

"investment",

investment_saturation_adstock,

exact("investment"),

),

# Visits

(

"visit_sales",

LinearEffect("additive", prior=dist.Beta(2, 2)),

exact("visits"),

),

],

scale=1,

)

naive_model.fit(y=y, X=X) 0%| | 0/1 [00:00<?, ?it/s]100%|██████████| 1/1 [00:04<00:00, 4.21s/it, init loss: 6820.3190, avg. loss [1-1]: 6820.3190]100%|██████████| 1/1 [00:04<00:00, 4.21s/it, init loss: 6820.3190, avg. loss [1-1]: 6820.3190]Prophetverse(exogenous_effects=[('seasonality',

MultiplyEffects(effects=[('trend',

Forward(effect_name='trend')),

('seasonality',

LinearFourierSeasonality(fourier_terms_list=[1],

freq='D',

prior_scale=0.1,

sp_list=[30.25]))]),

None),

('investment',

MultiplyEffects(effects=[('trend',

Forward(effect_name='trend')),

('investment',

ChainedEffects(steps=[('adstock',...

max_effect_prior=<numpyro.distributions.continuous.HalfNormal object at 0x7f65c013d550 with batch shape () and event shape ()>))]))]),

'^investment$'),

('visit_sales',

LinearEffect(effect_mode='additive',

prior=<numpyro.distributions.continuous.Beta object at 0x7f6584da0dd0 with batch shape () and event shape ()>),

'^visits$')],

inference_engine=MAPInferenceEngine(progress_bar=True), scale=1,

trend=FlatTrend(changepoint_prior_scale=1000))Please rerun this cell to show the HTML repr or trust the notebook.Prophetverse(exogenous_effects=[('seasonality',

MultiplyEffects(effects=[('trend',

Forward(effect_name='trend')),

('seasonality',

LinearFourierSeasonality(fourier_terms_list=[1],

freq='D',

prior_scale=0.1,

sp_list=[30.25]))]),

None),

('investment',

MultiplyEffects(effects=[('trend',

Forward(effect_name='trend')),

('investment',

ChainedEffects(steps=[('adstock',...

max_effect_prior=<numpyro.distributions.continuous.HalfNormal object at 0x7f65c013d550 with batch shape () and event shape ()>))]))]),

'^investment$'),

('visit_sales',

LinearEffect(effect_mode='additive',

prior=<numpyro.distributions.continuous.Beta object at 0x7f6584da0dd0 with batch shape () and event shape ()>),

'^visits$')],

inference_engine=MAPInferenceEngine(progress_bar=True), scale=1,

trend=FlatTrend(changepoint_prior_scale=1000))FlatTrend(changepoint_prior_scale=1000)

MultiplyEffects(effects=[('trend', Forward(effect_name='trend')),

('seasonality',

LinearFourierSeasonality(fourier_terms_list=[1],

freq='D', prior_scale=0.1,

sp_list=[30.25]))])Forward(effect_name='trend')

LinearFourierSeasonality(fourier_terms_list=[1], freq='D', prior_scale=0.1,

sp_list=[30.25])MultiplyEffects(effects=[('trend', Forward(effect_name='trend')),

('investment',

ChainedEffects(steps=[('adstock',

GeometricAdstockEffect(decay_prior=<numpyro.distributions.continuous.InverseGamma object at 0x7f6584fbce50 with batch shape () and event shape ()>,

normalize=True)),

('saturation',

MichaelisMentenEffect(effect_mode='additive',

half_saturation_prior=<numpyro.distributions.continuous.HalfNormal object at 0x7f6584fbebd0 with batch shape () and event shape ()>,

max_effect_prior=<numpyro.distributions.continuous.HalfNormal object at 0x7f65c013d550 with batch shape () and event shape ()>))]))])Forward(effect_name='trend')

ChainedEffects(steps=[('adstock',

GeometricAdstockEffect(decay_prior=<numpyro.distributions.continuous.InverseGamma object at 0x7f6584fbce50 with batch shape () and event shape ()>,

normalize=True)),

('saturation',

MichaelisMentenEffect(effect_mode='additive',

half_saturation_prior=<numpyro.distributions.continuous.HalfNormal object at 0x7f6584fbebd0 with batch shape () and event shape ()>,

max_effect_prior=<numpyro.distributions.continuous.HalfNormal object at 0x7f65c013d550 with batch shape () and event shape ()>))])GeometricAdstockEffect(decay_prior=<numpyro.distributions.continuous.InverseGamma object at 0x7f6584fbce50 with batch shape () and event shape ()>,

normalize=True)MichaelisMentenEffect(effect_mode='additive',

half_saturation_prior=<numpyro.distributions.continuous.HalfNormal object at 0x7f6584fbebd0 with batch shape () and event shape ()>,

max_effect_prior=<numpyro.distributions.continuous.HalfNormal object at 0x7f65c013d550 with batch shape () and event shape ()>)LinearEffect(effect_mode='additive',

prior=<numpyro.distributions.continuous.Beta object at 0x7f6584da0dd0 with batch shape () and event shape ()>)MAPInferenceEngine(progress_bar=True)

delta_naive = get_treatment_effect(naive_model, X)

fig, ax = plt.subplots(figsize=(6, 4))

delta_true.plot(ax=ax, label="True Counterfactual Effect", color="C0")

delta_naive["sales"].plot(

ax=ax,

label="Naive Estimated Counterfactual Effect",

color="C1",

linestyle="--",

)

ax.set_title("Sales Prediction with mediator as input")

ax.set_ylabel("Sales")

ax.legend()

plt.tight_layout()

plt.show()

As we can see, the naive model significantly underestimates the effect of investment. It attributes the sales to visits, ignoring that investment caused those visits.

Front-door adjustment model

To correctly estimate the effect of investment while utilizing the data from visits, we need to model the causal structure. This is often called a Front-door adjustment or simply structural modeling.

In Prophetverse, we can achieve this by defining a Latent Variable for visits.

- Latent Visits: We define

latent/visitsas a function ofinvestment(plus trend/seasonality). This represents the “expected visits” given the investment. - Coupling: We link this

latent/visitsto the observedvisitsdata usingCoupledExactLikelihood. This tells the model: “Thelatent/visitsvariable should be close to the observedvisitsdata.” - Sales Model: We use

latent/visitsas an input to explainsales.

This way, investment is the source of the variation in latent/visits, which in turn explains sales. The model understands that investment causes sales through visits.

graph LR

I[Investment] --> LV((Latent Visits))

LV -.->|Coupled| V[Observed Visits]

LV --> S[Sales]

Let’s implement this in Prophetverse.

model = Prophetverse(

trend=FlatTrend(changepoint_prior_scale=1000),

inference_engine=MAPInferenceEngine(progress_bar=True),

exogenous_effects=[

# Multiplicative seasonality

seasonality,

# Now, the investment creates a latent component of "visits"

(

"latent/visits",

investment_saturation_adstock,

exact("investment"),

),

# We use identity to put the mediator as a latent component

(

"latent/visit_input",

Identity(),

exact("visits"),

),

# Both latent components should be coupled

(

"latent/coupled_likelihood",

CoupledExactLikelihood(

source_effect_name="latent/visits",

target_effect_name="latent/visit_input",

prior_scale=0.1,

),

None,

),

# We then convert the latent component to sales

(

"visit_sales",

MultiplyEffects(

effects=[

("awareness", Forward("latent/visits")),

(

"conversion",

Constant(prior=dist.Beta(2, 2)),

),

]

),

None,

),

],

scale=1,

)

model.fit(y=y, X=X) 0%| | 0/1 [00:00<?, ?it/s]100%|██████████| 1/1 [00:07<00:00, 7.05s/it, init loss: 6336.8862, avg. loss [1-1]: 6336.8862]100%|██████████| 1/1 [00:07<00:00, 7.05s/it, init loss: 6336.8862, avg. loss [1-1]: 6336.8862]Prophetverse(exogenous_effects=[('seasonality',

MultiplyEffects(effects=[('trend',

Forward(effect_name='trend')),

('seasonality',

LinearFourierSeasonality(fourier_terms_list=[1],

freq='D',

prior_scale=0.1,

sp_list=[30.25]))]),

None),

('latent/visits',

MultiplyEffects(effects=[('trend',

Forward(effect_name='trend')),

('investment',

ChainedEffects(steps=[('adstoc...

target_effect_name='latent/visit_input'),

None),

('visit_sales',

MultiplyEffects(effects=[('awareness',

Forward(effect_name='latent/visits')),

('conversion',

Constant(prior=<numpyro.distributions.continuous.Beta object at 0x7f657492e790 with batch shape () and event shape ()>))]),

None)],

inference_engine=MAPInferenceEngine(progress_bar=True), scale=1,

trend=FlatTrend(changepoint_prior_scale=1000))Please rerun this cell to show the HTML repr or trust the notebook.Prophetverse(exogenous_effects=[('seasonality',

MultiplyEffects(effects=[('trend',

Forward(effect_name='trend')),

('seasonality',

LinearFourierSeasonality(fourier_terms_list=[1],

freq='D',

prior_scale=0.1,

sp_list=[30.25]))]),

None),

('latent/visits',

MultiplyEffects(effects=[('trend',

Forward(effect_name='trend')),

('investment',

ChainedEffects(steps=[('adstoc...

target_effect_name='latent/visit_input'),

None),

('visit_sales',

MultiplyEffects(effects=[('awareness',

Forward(effect_name='latent/visits')),

('conversion',

Constant(prior=<numpyro.distributions.continuous.Beta object at 0x7f657492e790 with batch shape () and event shape ()>))]),

None)],

inference_engine=MAPInferenceEngine(progress_bar=True), scale=1,

trend=FlatTrend(changepoint_prior_scale=1000))FlatTrend(changepoint_prior_scale=1000)

MultiplyEffects(effects=[('trend', Forward(effect_name='trend')),

('seasonality',

LinearFourierSeasonality(fourier_terms_list=[1],

freq='D', prior_scale=0.1,

sp_list=[30.25]))])Forward(effect_name='trend')

LinearFourierSeasonality(fourier_terms_list=[1], freq='D', prior_scale=0.1,

sp_list=[30.25])MultiplyEffects(effects=[('trend', Forward(effect_name='trend')),

('investment',

ChainedEffects(steps=[('adstock',

GeometricAdstockEffect(decay_prior=<numpyro.distributions.continuous.InverseGamma object at 0x7f6584fbce50 with batch shape () and event shape ()>,

normalize=True)),

('saturation',

MichaelisMentenEffect(effect_mode='additive',

half_saturation_prior=<numpyro.distributions.continuous.HalfNormal object at 0x7f6584fbebd0 with batch shape () and event shape ()>,

max_effect_prior=<numpyro.distributions.continuous.HalfNormal object at 0x7f65c013d550 with batch shape () and event shape ()>))]))])Forward(effect_name='trend')

ChainedEffects(steps=[('adstock',

GeometricAdstockEffect(decay_prior=<numpyro.distributions.continuous.InverseGamma object at 0x7f6584fbce50 with batch shape () and event shape ()>,

normalize=True)),

('saturation',

MichaelisMentenEffect(effect_mode='additive',

half_saturation_prior=<numpyro.distributions.continuous.HalfNormal object at 0x7f6584fbebd0 with batch shape () and event shape ()>,

max_effect_prior=<numpyro.distributions.continuous.HalfNormal object at 0x7f65c013d550 with batch shape () and event shape ()>))])GeometricAdstockEffect(decay_prior=<numpyro.distributions.continuous.InverseGamma object at 0x7f6584fbce50 with batch shape () and event shape ()>,

normalize=True)MichaelisMentenEffect(effect_mode='additive',

half_saturation_prior=<numpyro.distributions.continuous.HalfNormal object at 0x7f6584fbebd0 with batch shape () and event shape ()>,

max_effect_prior=<numpyro.distributions.continuous.HalfNormal object at 0x7f65c013d550 with batch shape () and event shape ()>)Identity()

CoupledExactLikelihood(prior_scale=0.1, source_effect_name='latent/visits',

target_effect_name='latent/visit_input')MultiplyEffects(effects=[('awareness', Forward(effect_name='latent/visits')),

('conversion',

Constant(prior=<numpyro.distributions.continuous.Beta object at 0x7f657492e790 with batch shape () and event shape ()>))])Forward(effect_name='latent/visits')

Constant(prior=<numpyro.distributions.continuous.Beta object at 0x7f657492e790 with batch shape () and event shape ()>)

MAPInferenceEngine(progress_bar=True)

delta_frontdoor = get_treatment_effect(model, X)

fig, ax = plt.subplots(figsize=(6, 4))

delta_true.plot(ax=ax, label="True Counterfactual Effect", color="C0")

delta_naive["sales"].plot(ax=ax, label="Naive Estimated Counterfactual Effect", color="C1", linestyle="--")

delta_frontdoor["sales"].plot(ax=ax, label="Front-door Estimated Counterfactual Effect", color="C2", linestyle="--")

ax.set_title("Sales Prediction with Front-door Adjustment")

ax.set_ylabel("Sales")

ax.legend()

plt.tight_layout()

plt.show()

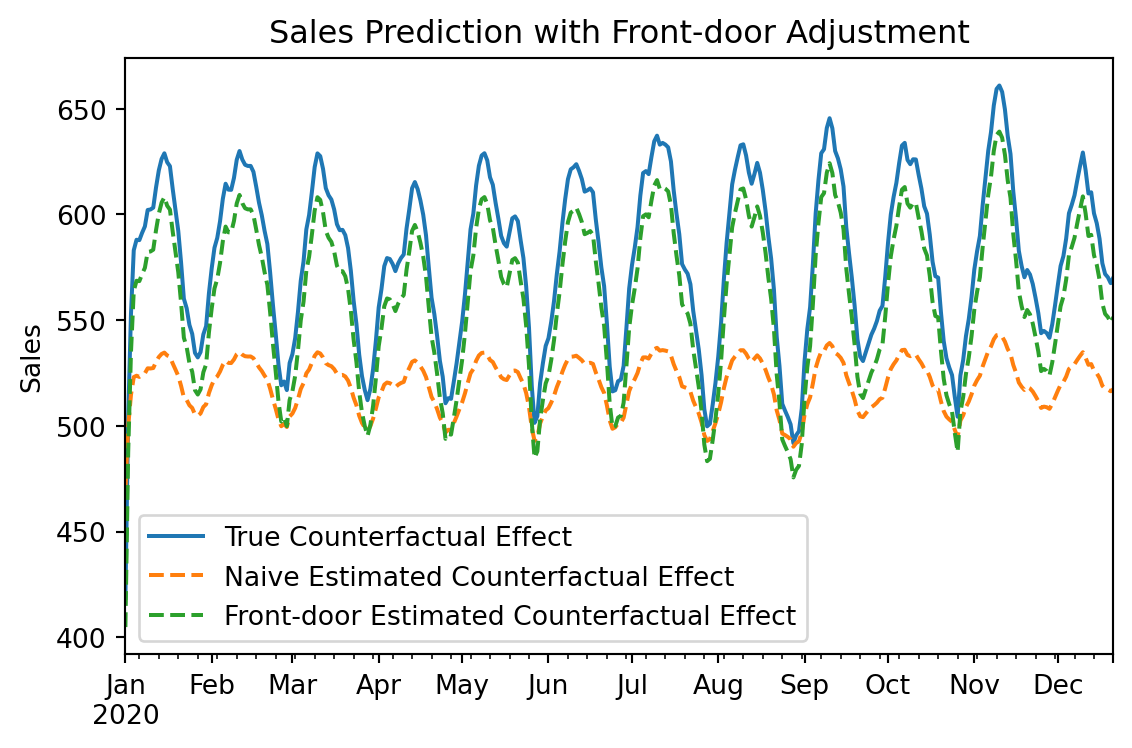

The plot above shows that the Front-door adjustment model (Green) recovers the True Counterfactual Effect (Blue) much better than the Naive model (Orange).

By explicitly modeling the mechanism Investment -> Visits -> Sales, we can:

- Use the

visitsdata to constrain the model and reduce uncertainty. - Correctly attribute the sales lift to the original investment.

- Estimate the conversion rate from visits to sales separately from the effect of investment on visits.

This approach is powerful for MMM when you have rich funnel data and want to understand the full impact of your marketing activities.