| revenue | |

|---|---|

| 2020-01-01 | 0.284627 |

| 2020-01-02 | 0.652842 |

| 2020-01-03 | 0.860751 |

| 2020-01-04 | 0.802704 |

| 2020-01-05 | 0.285768 |

Basics of Prophetverse API

Prophetverse is a powerful tool for building customized and glass-box forecasting and mix models. In Prophetverse, we define each component of the model as a separate effect, making this library extremely flexible to attend your specific needs.

In this page, we will:

- Understand the structure of

y(the target) andX(media & control variables) using the sktime interface.

- Understand the hyperparameters of Prophetverse

- Fit your first Bayesian MMM and generate forecasts.

1. Data Structures (y and X)

Prophetverse uses the sktime forecasting API. The essentials:

y: a pandas DataFrame indexed by a time index (pd.DatetimeIndexorpd.PeriodIndex). Single column for univariate MMM (e.g.revenue):

For panel datasets (e.g. in the case of multiple products or regions), use a MultiIndex, where the first index level is the entity (e.g. product or region) and the second level is the time.

| revenue | ||

|---|---|---|

| product | ||

| product_a | 2020-01-01 | 0.878795 |

| 2020-01-02 | 0.989028 | |

| 2020-01-03 | 0.059886 | |

| 2020-01-04 | 0.212564 | |

| 2020-01-05 | 0.688541 | |

| ... | ... | ... |

| product_c | 2020-12-27 | 0.569344 |

| 2020-12-28 | 0.683621 | |

| 2020-12-29 | 0.189618 | |

| 2020-12-30 | 0.883356 | |

| 2020-12-31 | 0.158255 |

1098 rows × 1 columns

X: a pandas DataFrame aligned on the same index containing exogenous variables (media spend, price, promotions, macro, etc.). Columns are arbitrary names.

The index type should always be the same for y and X, and every dataframe you use. After choosing Datetime or Period index for y, use the same type for X.

Example of dataset

Here we load a synthetic dataset:

from prophetverse.datasets._mmm.dataset1 import get_dataset

(y, X, *_) = get_dataset()

y.head()/opt/hostedtoolcache/Python/3.11.14/x64/lib/python3.11/site-packages/tqdm/auto.py:21: TqdmWarning: IProgress not found. Please update jupyter and ipywidgets. See https://ipywidgets.readthedocs.io/en/stable/user_install.html

from .autonotebook import tqdm as notebook_tqdm2000-01-01 10815512.0

2000-01-02 11120677.0

2000-01-03 11260387.0

2000-01-04 11322533.0

2000-01-05 11321180.0

Freq: D, dtype: float32The X looks like this:

X.head()| ad_spend_search | ad_spend_social_media | |

|---|---|---|

| 2000-01-01 | 89076.191178 | 98587.488958 |

| 2000-01-02 | 88891.993106 | 99066.321168 |

| 2000-01-03 | 89784.955064 | 97334.106903 |

| 2000-01-04 | 89931.220681 | 101747.300585 |

| 2000-01-05 | 89184.319596 | 93825.221809 |

We will split the dataset into training and testing sets.

from sktime.split import temporal_train_test_split

y_train, y_test, X_train, X_test = temporal_train_test_split(y, X, test_size=0.2)2. Prophetverse model

Think of Prophetverse as the conerstone of you MMM model. It is a flexible class that allows you to define the trend, seasonality, and custom exogenous effects of your model.

Simple Prophetverse model

We can use a simple Prophetverse model with Linear effects and a seasonality component:

from prophetverse import Prophetverse, LinearEffect, LinearFourierSeasonality

from prophetverse.utils.regex import starts_with, no_input_columns

seasonality_effect = LinearFourierSeasonality(

sp_list=[365.25, 7],

fourier_terms_list=[10, 3],

prior_scale=0.1,

freq="D",

effect_mode="additive",

)

ad_spend_effect = LinearEffect()

model = Prophetverse(

exogenous_effects=[

("ad_spend", ad_spend_effect, starts_with("ad")),

("seasonality", seasonality_effect, no_input_columns),

],

)

model.fit(y=y_train, X=X_train)Prophetverse(exogenous_effects=[('ad_spend', LinearEffect(), '^(?:ad)'),

('seasonality',

LinearFourierSeasonality(fourier_terms_list=[10,

3],

freq='D',

prior_scale=0.1,

sp_list=[365.25, 7]),

'^$')])Please rerun this cell to show the HTML repr or trust the notebook.Prophetverse(exogenous_effects=[('ad_spend', LinearEffect(), '^(?:ad)'),

('seasonality',

LinearFourierSeasonality(fourier_terms_list=[10,

3],

freq='D',

prior_scale=0.1,

sp_list=[365.25, 7]),

'^$')])PiecewiseLinearTrend()

LinearEffect()

LinearFourierSeasonality(fourier_terms_list=[10, 3], freq='D', prior_scale=0.1,

sp_list=[365.25, 7])MCMCInferenceEngine()

By default, the model will run a MCMC inference to obtain the parameters. We can, however, easily switch to a MAP inference by setting inference_engine=MAPInferenceEngine() in the model constructor. The MAP inference is generally faster but provides point estimates of the parameters.

To run in-sample and out-of-sample forecasts of total revenue, we can simply call predict. We need to pass a “forecasting horizon” (fh) object, that should preferably be an index of the type of our y and X’s index. Since we want to forecast for both train and test timepoints, we use y.index as fh, and pass the full X as exogenous variables.

fh = y.index

y_pred = model.predict(fh=fh, X=X)

y_pred2000-01-01 14483120.0

2000-01-02 14349842.0

2000-01-03 14425632.0

2000-01-04 14234289.0

2000-01-05 14376405.0

...

2004-12-28 32365182.0

2004-12-29 32117918.0

2004-12-30 32005472.0

2004-12-31 32258116.0

2005-01-01 32360856.0

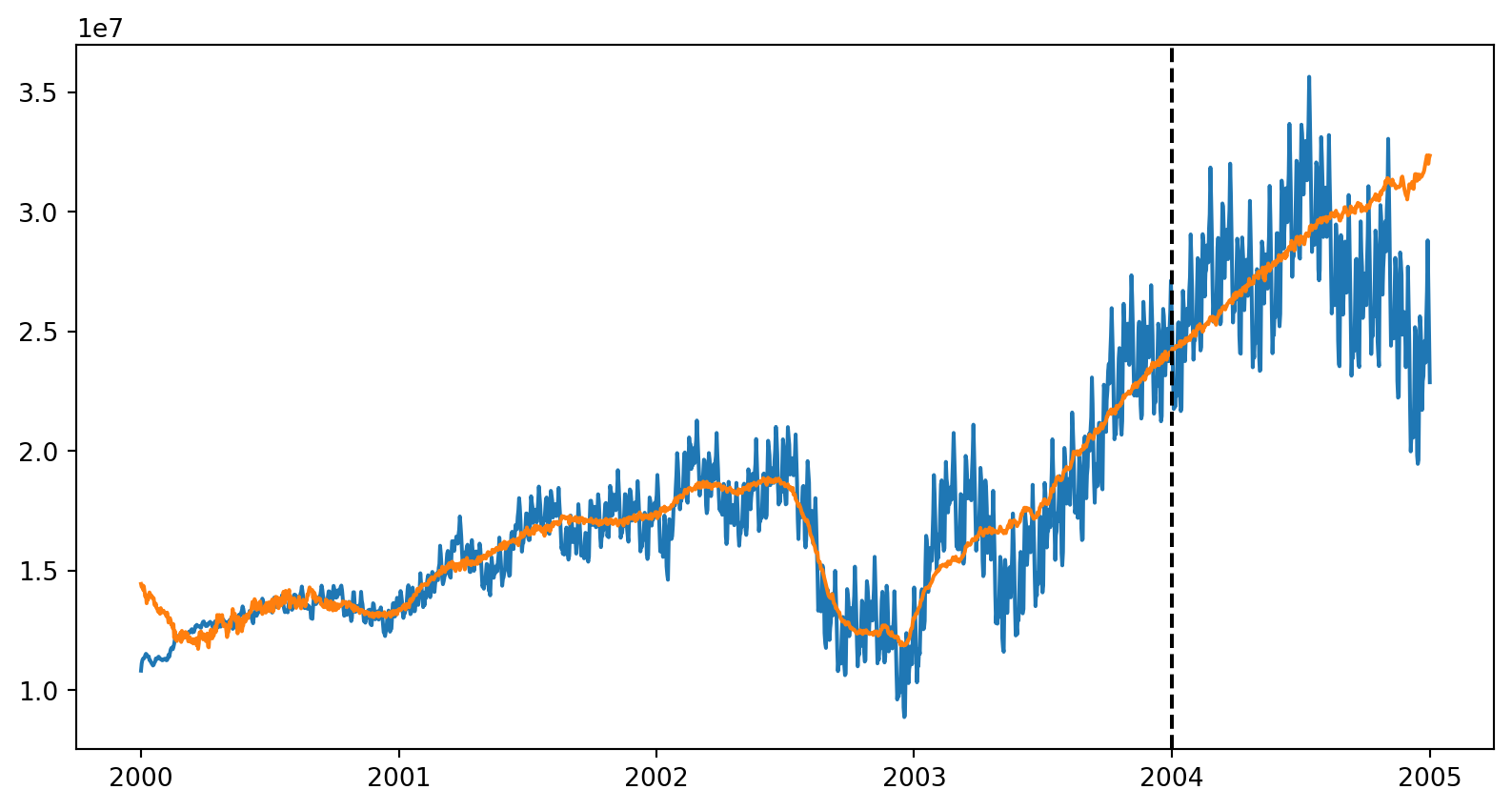

Freq: D, Length: 1828, dtype: float32import matplotlib.pyplot as plt

def plot_forecasts(y_pred):

fig, ax = plt.subplots(figsize=(10,5))

ax.plot(y.index.to_timestamp(), y)

ax.plot(y_pred.index, y_pred)

ax.axvline(y_train.index.max().to_timestamp(), color="black", linestyle="--", label="Train/Test split")

fig.show()

plot_forecasts(y_pred)

Getting the components

To obtain the contribution of each component, you can use the predict_components method:

components = model.predict_components(fh=fh, X=X)

components.head()| ad_spend | mean | obs | seasonality | trend | |

|---|---|---|---|---|---|

| 2000-01-01 | 1951345.875 | 14483120.0 | 14500401.0 | 614.704651 | 12531161.0 |

| 2000-01-02 | 1917232.500 | 14349842.0 | 14266047.0 | -50484.121094 | 12483091.0 |

| 2000-01-03 | 2016962.625 | 14425632.0 | 14459742.0 | -26353.626953 | 12435021.0 |

| 2000-01-04 | 1874735.000 | 14234289.0 | 14181142.0 | -27398.041016 | 12386951.0 |

| 2000-01-05 | 2079018.125 | 14376405.0 | 14344686.0 | -41493.980469 | 12338882.0 |

If you want to obtain all the sample to compute, for example, probabilistic intervals and measure the risk, you can use the predict_component_samples method:

samples = model.predict_component_samples(fh=fh, X=X)

samples| ad_spend | mean | obs | seasonality | trend | ||

|---|---|---|---|---|---|---|

| sample | ||||||

| 0 | 2000-01-01 | 1182749.500 | 13707321.0 | 12335327.0 | -15333.103516 | 12539905.0 |

| 2000-01-02 | 1158945.250 | 13661526.0 | 13223348.0 | -23272.130859 | 12525853.0 | |

| 2000-01-03 | 1249228.625 | 13742996.0 | 12519516.0 | -18033.396484 | 12511801.0 | |

| 2000-01-04 | 1125272.125 | 13619009.0 | 14577379.0 | -4012.927979 | 12497750.0 | |

| 2000-01-05 | 1321673.125 | 13799107.0 | 12858874.0 | -6265.105469 | 12483698.0 | |

| ... | ... | ... | ... | ... | ... | ... |

| 999 | 2004-12-28 | 5269823.000 | 31613836.0 | 30836816.0 | -16992.765625 | 26361004.0 |

| 2004-12-29 | 4986981.000 | 31321890.0 | 31899526.0 | -45524.140625 | 26380432.0 | |

| 2004-12-30 | 4852499.000 | 31175388.0 | 31748786.0 | -76963.437500 | 26399854.0 | |

| 2004-12-31 | 5050830.500 | 31449106.0 | 31127286.0 | -21041.710938 | 26419318.0 | |

| 2005-01-01 | 5125169.000 | 31548410.0 | 33430684.0 | -15503.842773 | 26438742.0 |

1828000 rows × 5 columns